Payroll Taxes Report In Quickbooks . learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. You can find reports about employee info, wages, taxes, deductions, and many more payroll. access payroll reports. the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. streamline your payroll tax info and make managing your team. payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you need to pay for. recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,.

from www.youtube.com

recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. access payroll reports. learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. streamline your payroll tax info and make managing your team. payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you need to pay for. You can find reports about employee info, wages, taxes, deductions, and many more payroll. payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings.

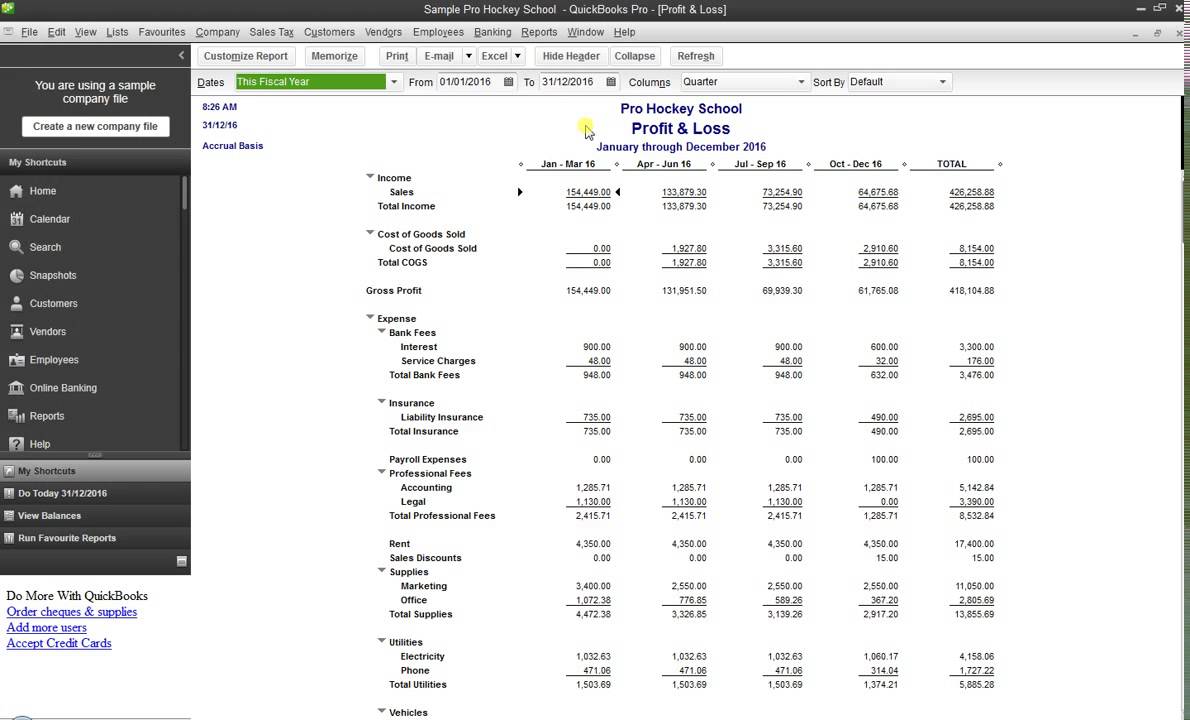

Quickbooks profit and loss report by quarter HD YouTube

Payroll Taxes Report In Quickbooks the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you need to pay for. learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. access payroll reports. streamline your payroll tax info and make managing your team. You can find reports about employee info, wages, taxes, deductions, and many more payroll. payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,.

From fitsmallbusiness.com

How to Run QuickBooks Payroll Reports Payroll Taxes Report In Quickbooks recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you need to pay for. streamline your payroll tax info and make managing your team. You can find reports about employee. Payroll Taxes Report In Quickbooks.

From hevodata.com

QuickBooks Payroll Report 4 Critical Aspects Learn Hevo Payroll Taxes Report In Quickbooks streamline your payroll tax info and make managing your team. payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you need to pay for. You can find reports about employee info, wages, taxes, deductions, and many more payroll. payroll reports document employee time worked,. Payroll Taxes Report In Quickbooks.

From nationalgriefawarenessday.com

Quickbooks Pay Stub Template Template Business Payroll Taxes Report In Quickbooks You can find reports about employee info, wages, taxes, deductions, and many more payroll. payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. access payroll reports. payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you. Payroll Taxes Report In Quickbooks.

From quickbooks.intuit.com

What is a Pay Stub? 2021 Guide to Employee Pay Stubs QuickBooks Payroll Taxes Report In Quickbooks payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. access payroll reports. learn how to create a payroll summary report to see what you've paid out. Payroll Taxes Report In Quickbooks.

From blog.sunburstsoftwaresolutions.com

Create a QuickBooks Job Cost Report With Hours & Payroll Costs Payroll Taxes Report In Quickbooks streamline your payroll tax info and make managing your team. payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you need to pay for. access payroll reports. You can find reports about employee info, wages, taxes, deductions, and many more payroll. payroll reports. Payroll Taxes Report In Quickbooks.

From cashier.mijndomein.nl

Quickbooks Payroll Template Payroll Taxes Report In Quickbooks the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. streamline your payroll tax info and make managing your team. access payroll reports. recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. You can find reports about employee info,. Payroll Taxes Report In Quickbooks.

From www.youtube.com

Intuit QuickBooks Payroll Create a Paycheck for SCorp with Tax Payroll Taxes Report In Quickbooks payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you need to pay for. You can find reports about employee info, wages, taxes, deductions, and many more payroll. streamline your payroll tax info and make managing your team. access payroll reports. the payroll. Payroll Taxes Report In Quickbooks.

From sonary.com

How QuickBooks Payroll Can Help Small Business Owners Save Time and Payroll Taxes Report In Quickbooks payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. You can find reports about employee info, wages, taxes, deductions, and many more payroll. recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. access payroll reports. the payroll tax and wage summary report is. Payroll Taxes Report In Quickbooks.

From www.thebalancesmb.com

QuickBooks Reports Employee and Payroll Reports Payroll Taxes Report In Quickbooks streamline your payroll tax info and make managing your team. recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. learn how to create a payroll summary report to see. Payroll Taxes Report In Quickbooks.

From www.youtube.com

Quarterly Payroll Form 941 & Payroll Report Forms From QuickBooks YouTube Payroll Taxes Report In Quickbooks recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. payroll reports. Payroll Taxes Report In Quickbooks.

From mypaysolutions.thomsonreuters.com

Payroll reports myPay Solutions Thomson Reuters Payroll Taxes Report In Quickbooks recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. payroll tax liability reports show how much payroll tax you have paid for previous payrolls, as well as how much payroll tax you need to. Payroll Taxes Report In Quickbooks.

From www.halfpricesoft.com

ezPaycheck Payroll How to Prepare Quarterly Tax Report Payroll Taxes Report In Quickbooks payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. access payroll reports. You can find reports about employee info, wages, taxes, deductions, and many more payroll. . Payroll Taxes Report In Quickbooks.

From quickbooks.intuit.com

How should I enter the previous ADP Payroll into Quickbooks? Payroll Taxes Report In Quickbooks payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. streamline your payroll tax info and make managing your team. the payroll tax and wage summary report is a great way. Payroll Taxes Report In Quickbooks.

From www.youtube.com

Sales tax report in quickbooks sales tax report QuickBooks tutorial Payroll Taxes Report In Quickbooks payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. streamline your payroll tax info and make managing your team. recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. access payroll reports. learn how to create a payroll summary report to see what. Payroll Taxes Report In Quickbooks.

From www.youtube.com

QuickBooks Paying Sales Tax in QuickBooks Financial YouTube Payroll Taxes Report In Quickbooks access payroll reports. You can find reports about employee info, wages, taxes, deductions, and many more payroll. payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. recording payroll tax payments. Payroll Taxes Report In Quickbooks.

From hevodata.com

How to Use Quickbooks Online Simple Start Simplified A Comprehensive Payroll Taxes Report In Quickbooks streamline your payroll tax info and make managing your team. access payroll reports. learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,. the payroll tax and wage summary report is a great. Payroll Taxes Report In Quickbooks.

From www.pinterest.com

Quickbooks Pay Stub Template Payroll template, Statement template Payroll Taxes Report In Quickbooks learn how to create a payroll summary report to see what you've paid out in your quickbooks payroll. access payroll reports. You can find reports about employee info, wages, taxes, deductions, and many more payroll. streamline your payroll tax info and make managing your team. the payroll tax and wage summary report is a great way. Payroll Taxes Report In Quickbooks.

From www.wizxpert.com

How to Adjust Payroll Liabilities in QuickBooks Desktop Payroll Taxes Report In Quickbooks payroll reports document employee time worked, wages paid, federal taxes withheld, state taxes withheld, and other withholdings. access payroll reports. the payroll tax and wage summary report is a great way to find the information you need for state or local taxes. recording payroll tax payments in quickbooks desktop involves accurately documenting the tax amounts paid,.. Payroll Taxes Report In Quickbooks.